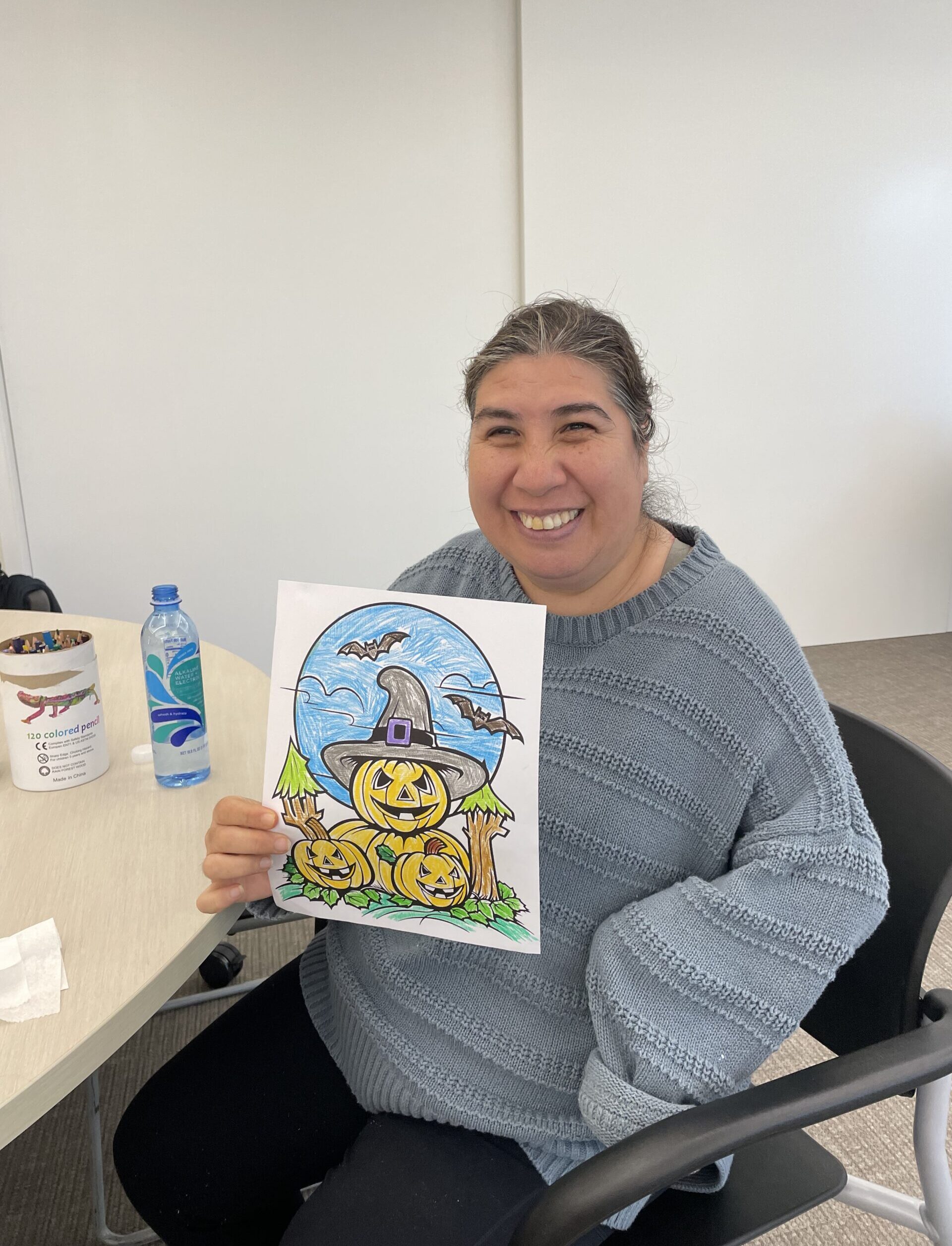

Adult Day Program Services

A licensed day program in Lafayette, CA that serves participants five days a week, for 6 hours a day. Our day program takes place in our new state-of-the-art facility and implements our new DISCOVER model.

Learn MoreSupported and Independent Living Services

At Las Trampas, we are committed to providing the necessary supports and training to help individuals live in homes of their own and thrive in the community.

Learn MoreLicensed Adult Residential Services

Specialized behavioral living services in licensed residential facilities for individuals who have previously been served in an institutional setting.

Learn More

Every Gift Makes A Difference

Here are several ways YOU can make a difference in the lives of individuals with developmental disabilities.

Read More